Best Ways for Passive Income. Welcome to a world where financial independence and freedom are within your grasp! In this blog post, we will explore the best ways to generate passive income, helping you achieve your financial goals and build a secure future for yourself and your loved ones.

Whether you’re a beginner or an experienced individual looking for ways to enhance your passive income, this comprehensive guide will equip you with the knowledge and strategies you need to succeed.

We will delve into various passive income opportunities, including affiliate marketing, digital marketing, and email marketing while uncovering the secrets of creating a passive income dynasty. Let’s dive right in!

Understanding Passive Income

Before we dive into the different ways of earning passive income, it’s essential to understand what passive income truly means. Passive income refers to any income generated with minimal effort on your part, where you can earn money even when you’re not actively working.

Unlike active income, which requires constant effort and time investment, passive income presents an opportunity to leverage your resources and assets to generate revenue continuously.

It allows you to break free from the constraints of trading your time for money, providing you with the flexibility and financial stability necessary to live life on your terms.

Examples of Passive Income

To truly the power and potential of passive income, let’s explore some real-life examples of individuals who have successfully created passive income streams:

- Rental Properties: Investing in real estate and earning rental income is a classic example of passive income. By owning and leasing out properties, you can generate a steady monthly income.

- Dividend Investing: By investing in dividend-paying stocks and bonds, you can earn regular income from the dividends distributed by the companies.

- Royalty Payments: If you have creative talents or intellectual property, you can earn passive income through royalties. This could include earning royalties from books, music, patents, or licensing your artwork.

- Online Course Creation: Developing and selling online courses on platforms like Udemy or Teachable allows you to earn passive income as people purchase and enroll in your courses.

- Peer-to-Peer Lending: Through peer-to-peer lending platforms, you can lend money to individuals or businesses and earn interest on your investments.

These are just a few examples of the countless passive income opportunities available. Now, let’s deep dive into some of the best ways to create passive income.

Best Ways for Passive Income

Affiliate Marketing: Earn Passive Income Through Online Promotions

Affiliate marketing has emerged as one of the best ways to generate passive income in the digital age. It involves partnering with brands and promoting their products or services through personalized affiliate links. When someone purchases through your affiliate link, you earn a commission. Here’s how you can get started with affiliate marketing:

- Find a Niche: Identify a niche or industry that aligns with your interests and expertise. This will make it easier for you to create content and promote relevant products.

- Select Affiliate Programs: Research and join reputable affiliate programs related to your niche. Consider factors such as commission rates, product quality, and affiliate support.

- Create Engaging Content: Produce high-quality content, such as blog posts, videos, or social media posts, that educate and inspire your target audience. Incorporate affiliate links naturally within your content.

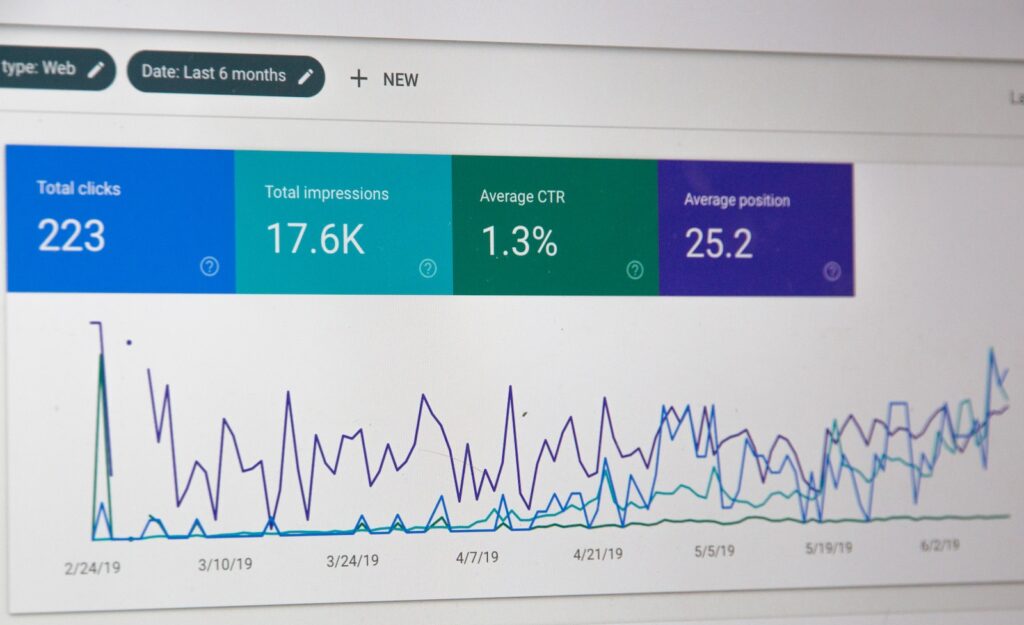

- Drive Traffic: Utilize various online marketing strategies to drive traffic to your content. This could include search engine optimization (SEO), social media marketing, email marketing, or collaborations with other bloggers or influencers.

- Track and Optimize: Monitor your affiliate marketing performance and make data-driven decisions to optimize your campaigns. Analyze which products resonate with your audience and focus on promoting them.

By consistently creating valuable content and strategically promoting affiliate products, you can build a reliable passive income stream through affiliate marketing.

Digital Marketing: Leveraging Online Platforms for Passive Income

In today’s digital world, digital marketing offers numerous opportunities to generate passive income. Whether it’s through blogging, creating online courses, or selling digital products, digital marketing allows you to leverage your skills and knowledge to reach a global audience. Here’s how you can harness digital marketing for passive income:

- Create a Blog: Start a blog on a topic you’re passionate and knowledgeable about. Optimize your blog for search engines, such as Google, to attract organic traffic. Monetize your blog through various strategies, such as display advertising or sponsored content.

- Develop Online Courses: Share your expertise by creating and selling online courses. Platforms like Udemy, Coursera, and Teachable provide a user-friendly interface to host and monetize your courses.

- Sell Digital Products: Leverage your creativity by designing and selling digital products, such as e-books, templates, graphics, or software. Platforms like Etsy or your website can serve as marketplaces for your digital creations.

- Offer Consulting Services: If you possess specialized knowledge or skills, consider offering consulting services online. This allows you to earn passive income by providing valuable guidance and advice to clients.

Digital marketing opens up a world of passive income possibilities, allowing you to monetize your skills and expertise on a global scale.

Email Marketing: Building Profitable Connections

Email marketing remains one of the most effective ways to build profitable connections with your audience and generate passive income.

By cultivating an engaged email list, you can nurture relationships and promote relevant products or services. Here’s how you can leverage email marketing for passive income:

- Build an Email List: Create lead magnets, such as e-books or industry reports, to entice visitors to subscribe to your email list. Place opt-in forms strategically on your website or social media platforms.

- Provide Value: Send regular newsletters or emails that provide valuable content to your subscribers. Share tips, insights, and exclusive offers.

- Recommend Relevant Products: Introduce your subscribers to products or services you genuinely believe in and have personally used. Offer special discounts or bonuses for your subscribers to incentivize conversions.

- Automate Email Sequences: Set up automated email sequences that nurture your subscribers and guide them through the buyer’s journey. This ensures a consistent flow of passive income as new subscribers join your list.

Remember, building trust and providing genuine value to your subscribers is key to successful email marketing and passive income generation.

Passive Income Dynasty: The Ultimate Goal

While earning passive income is undoubtedly desirable, aiming to build a passive income dynasty should be the ultimate goal. A passive income dynasty refers to a collection of diverse and sustainable income streams that generate consistent wealth for generations to come. To build a passive income dynasty, consider the following strategies:

- Diversify Your Income Streams: Relying on a single source of passive income can be risky. Diversify your passive income by investing in various opportunities, such as real estate, stocks, bonds, businesses, or intellectual property.

- Reinvest Your Earnings: Instead of indulging in immediate gratification, reinvest your passive income into new projects or assets. Compounding your earnings will accelerate your journey toward building a passive income dynasty.

- Continuously Learn and Adapt: Stay updated with the latest trends, technologies, and investment opportunities. Continuously educate yourself and adapt to changing market conditions to safeguard and grow your passive income portfolio.

- Seek Professional Advice: Consider consulting with financial advisors, accountants, or investment experts who can provide guidance tailored to your specific financial goals. Their expertise can help you make informed decisions when it comes to managing and growing your passive income.

By adopting these strategies and cultivating a long-term mindset, you can lay a solid foundation for a passive income dynasty that will provide financial security for generations to come.

Passive Income for Beginners: Simple Steps to Get Started

Are you new to the realm of passive income and unsure where to start? Don’t worry; this section will guide you through the initial steps to kickstart your passive income journey:

- Set Financial Goals: Begin by setting clear financial goals. Determine how much passive income you aim to generate monthly or annually. Having specific goals will help you stay motivated and focused.

- Evaluate Your Skills and Interests: Identify your skills, interests, and expertise. Determine how you can monetize these assets to generate passive income.

- Research Passive Income Opportunities: Invest time in researching various passive income opportunities. Consider factors such as upfront investment, time commitment, and potential returns.

- Take Action: Once you have selected a passive income opportunity that aligns with your goals, take action. Start small, learn from experience, and gradually scale up your income streams.

Remember, the key to success lies in consistent effort, perseverance, and a willingness to learn from both successes and setbacks.

How to Increase Passive Income: Scaling Up for Greater Earnings

Once you have established a reliable passive income stream, it’s time to explore opportunities to increase your earnings. Here are some strategies to scale up your passive income:

- Expand Your Audience: Focus on growing your audience and reach. Use SEO, social media marketing, content marketing, and collaborations to attract more people to your website or content.

- Create Multiple Income Streams: Avoid relying on a single source of passive income. Diversify your portfolio by investing in additional income streams, such as new businesses, real estate properties, or stocks.

- Improve Conversion Rates: Optimize your sales funnels, landing pages, and content to increase conversion rates. A small improvement in conversion rates can result in significant growth in passive income.

- Outsource and Delegate: As your passive income grows, consider outsourcing and delegating tasks to free up your time. This allows you to focus on strategic decisions and scaling your income further.

By implementing these strategies, you can continually increase your passive income and achieve your financial goals.

What Generates Passive Income: Diversifying Revenue Streams

Passive income can be generated through various means. Let’s explore some of the most popular ways to diversify your revenue streams and generate passive income:

- Investments: Invest in assets such as stocks, bonds, mutual funds, or index funds. Over time, your investments can generate a steady stream of passive income through dividends, interest, or capital gains.

- Real Estate: Purchase rental properties or invest in real estate crowdfunding platforms. Rental income and property appreciation can provide long-term passive income.

- E-commerce: Establish an online store and sell physical or digital products. Utilize dropshipping or print-on-demand services to minimize inventory management.

- Peer-to-Peer Lending: Lend money directly to individuals or businesses through peer-to-peer lending platforms. Earn interest on your loans as borrowers repay.

- Royalties: Leverage your creativity by creating intellectual property, such as music, books, or artwork. License your creations to earn royalties.

- Dividend Stocks: Invest in dividend-paying stocks. As companies distribute profits to shareholders, you can earn a regular stream of passive income through dividends.

Remember, diversifying your revenue streams helps mitigate risk and ensures stable passive income even during economic fluctuations.

Passive Income of the Rich: Learn from the Masters

Looking at the passive income strategies of successful individuals can provide valuable insights and inspiration. Let’s explore some passive income habits and strategies adopted by the rich:

- Continual Learning: Successful individuals invest time and resources in continuous learning. They stay up-to-date with industry trends and explore new opportunities for passive income.

- Building Networks: Networking opens doors to new opportunities and collaborations. Successful individuals surround themselves with like-minded individuals and experts who can share knowledge and provide valuable insights.

- Embracing Technology: The rich embrace technological advancements and leverage them to their advantage. They harness automation, online platforms, and digital tools to streamline passive income generation processes.

- Patience and Long-Term Thinking: Creating sustainable passive income requires patience and a long-term mindset. The rich understand the importance of delayed gratification and make decisions that prioritize long-term wealth creation.

By adopting these strategies and insights from the rich, you can pave the way for your passive income success.

Passive Income for Millionaires: Strategies to Sustain Wealth

Once you have achieved significant passive income, it’s crucial to adopt strategies to sustain and grow your wealth. Here are some strategies commonly employed by millionaires:

- Asset Allocation: Diversify your portfolio by allocating your assets across various investments. Balance risk and reward by investing in different asset classes and geographical regions.

- Tax Optimization: Manage your taxes efficiently by leveraging tax-saving strategies, such as investing in tax-advantaged accounts, utilizing deductions, and working with knowledgeable tax professionals.

- Philanthropy and Giving Back: Consider philanthropic initiatives to create a positive impact and give back to society. Well-thought-out charitable giving can provide tax advantages while fulfilling social responsibilities.

- Family Trusts and Estate Planning: Protect and pass on your wealth by establishing trusts and implementing robust estate planning strategies. Consult with legal and financial professionals to ensure your assets are distributed according to your wishes.

Remember, sustaining and growing your wealth requires careful planning, discipline, and ongoing financial management.

Passive Income Jobs: Finding Lucrative Opportunities

If you prefer a more structured approach to passive income, certain job opportunities allow you to earn passive income while leveraging your skills and expertise. Here are some examples of passive income jobs:

- Real Estate Agent: While traditionally viewed as an active income profession, real estate agents can receive passive income through referral fees or investing in rental properties.

- Royalty Streams: If you possess creative talents, seek opportunities to earn royalties by licensing your music, books, or artwork.

- Influencer or Content Creator: Build a substantial following on social media platforms or YouTube and monetize your content through brand partnerships, sponsored posts, or affiliate marketing.

- Financial Advisor: By providing financial advice and managing clients’ investments, financial advisors can earn both active and passive income. Passive income arises from annual fees charged for managing clients’ portfolios.

- Software Development: Develop and sell software applications, plugins, or themes, allowing you to earn passive income from sales and subscriptions.

These passive income job opportunities combine your skills and interests with the potential to generate ongoing revenue without excessive time commitment.

Best Ways for Passive Income: Exploring Various Possibilities

Passive income opportunities are limitless, and the best form of passive income ultimately depends on your skills, resources, and personal preferences. Let’s explore a few popular forms of passive income:

- Rental Properties: By owning residential or commercial properties and leasing them out, you can earn passive income through rental payments.

- Dividend Investing: Investing in dividend-paying stocks of established companies allows you to earn regular passive income through dividend distributions.

- E-commerce: Running an online store, either independently or through platforms like Shopify, enables you to generate income from product sales while automating operations.

- Affiliate Marketing: Promote products or services through affiliate links on your website, blog, or social media platforms. Earn a commission when visitors make purchases through your links.

- Network Marketing: Join reputable network marketing companies and build a team. Earn passive income through commissions on the sales generated by your team.

- Rental Royalties: Own intellectual property, such as music, films, or patents, and earn income through royalties from licensing or sales.

Remember, the best passive income opportunity is one that aligns with your skills, interests, and long-term financial goals.

Conclusion

Congratulations on reaching the end of this comprehensive guide to the best ways for passive income!